Mirror, Mirror on the Wall... RCEP is the biggest of them all.

How the RCEP negotiations have once again blown India's trade frailties wide open

Signed on the 15th November, 2020, Regional Comprehensive Economic Partnership (RCEP hereafter) is one of the world’s largest multilateral Free Trade Agreements (FTAs hereafter) in play today. Its demographic coverage of almost a third of humanity, and its economic significance makes this grouping one of the most significant movements in global trade from the perspective of emerging market economies.

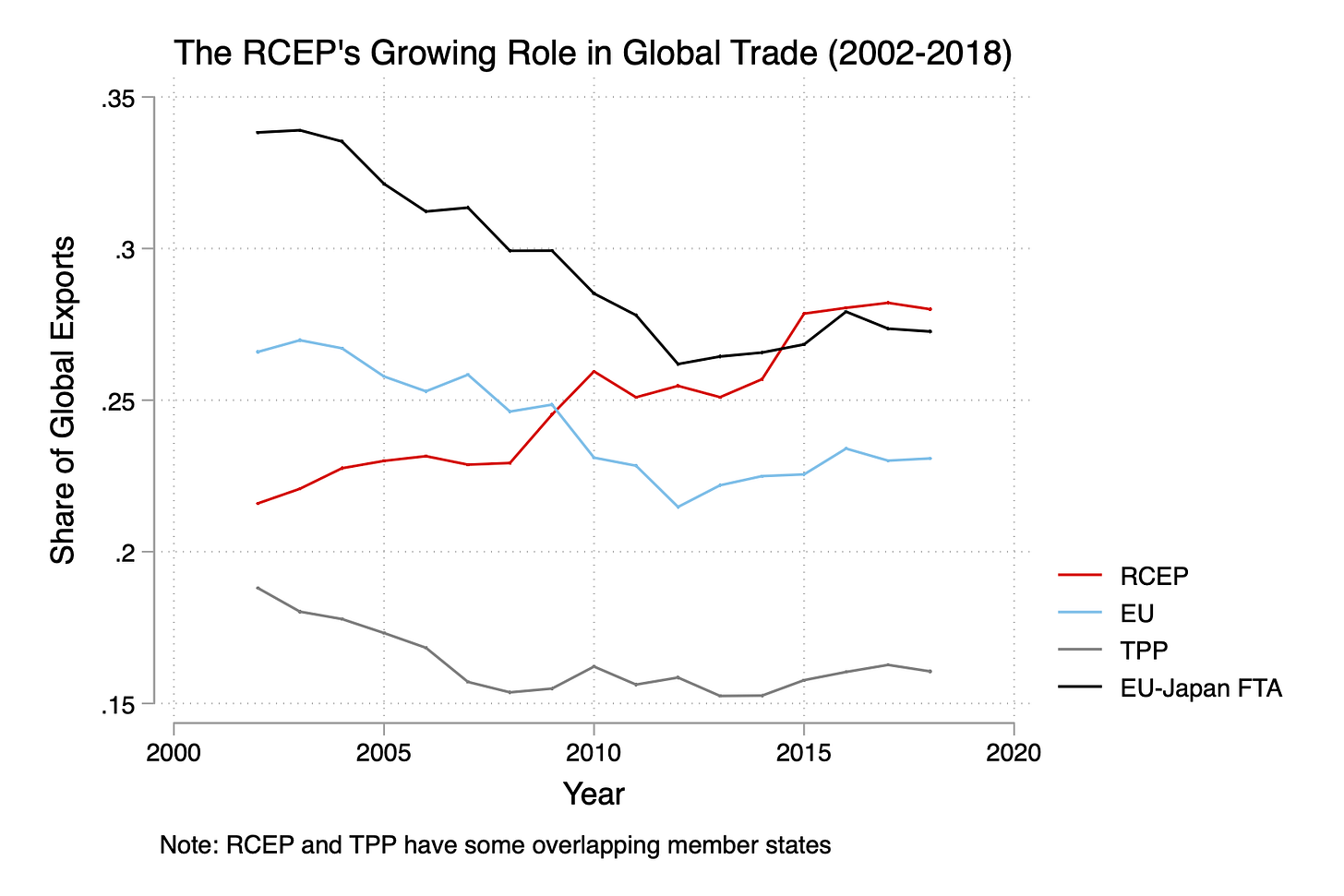

Its key distinction to most other trade deals of comparable size is the fact that it is, in majority, driven not just by key emerging market economies but also by economies which are beginning to exert a much more growing influence on global supply chains in recent times, such as Vietnam and Bangladesh. As underscored in Figure 1, the RCEP member states have accounted for a growing proportion of global trade and are set to become the largest trading bloc in existence today. As a collective dominated by EMEs, their share is only set to grow further in the coming days.

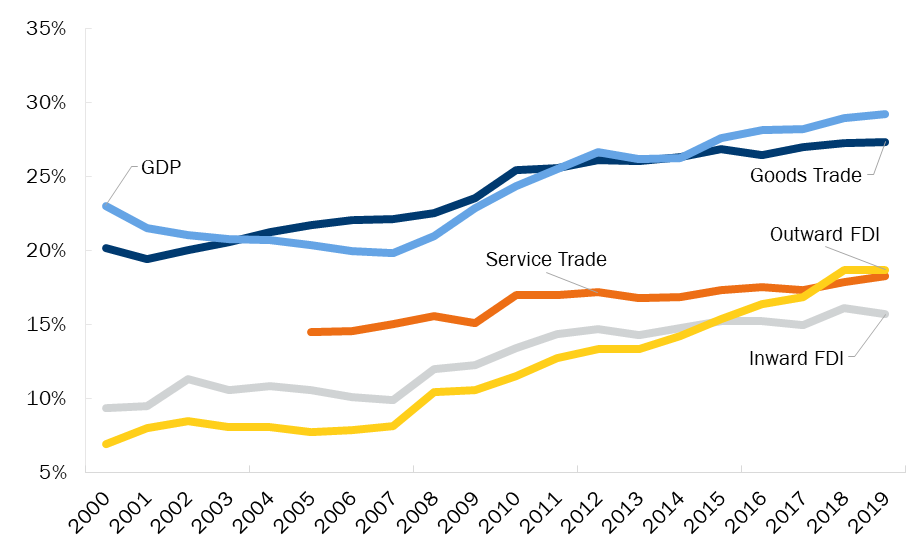

The RCEP is not just significant in terms of global trade but also along other economic parameters. The RCEP is more than just a conglomerate of EMEs engaged in freer trade, expanding into cross border investment flows among some of the fastest growing economies in the world. The global economic order is not only witnessing a re-alignment in trade and supply chains with emerging markets now taking increased centrality, but also seeing much larger outward cross border investment flows from many of these economies emerging market economies, which are now becoming growing sources of foreign capital and investment flows in the global economy. This is visible in the RCEP’s growing prominence in not just global GDP but along trade and investment flows, which is only expected to pick up further in the coming years.

The RCEP, however, remains conspicuous insofar as we look at the list of signatories and find no mention of India – a nation which had been actively involved in these negotiations until 2019. India has also been a very active participant and proponent with most of the ASEAN and ASEAN+ members who are now part of the RCEP through bilateral trade deals. These existing trade relations should have seen a logical and natural progression through India’s membership of the RCEP which would have also allowed India to gain a relatively greater foothold in many of these supply chains and investment flows which are set to become even more regionalised now in the aftermath of the COVID pandemic.

The dependence doesn’t however go both ways…

India’s bilateral trade with the ASEAN region and with the RCEP countries in general have only been increasing in the last four to five years, but still remains an extremely asymmetrical one. The RCEP as a bloc accounts for almost a fifth of India’s exports and a third of India’s merchandise imports (as of 2018), thereby implying our strong reliance on many of those countries as key trading partners. The corollary is however not true. While India’s share in exports from the RCEP bloc has grown over time, we still account for less than 3% of their export market and less than 1.5% of their import markets.

The same is true for India’s bilateral trade with ASEAN countries where India only accounts for 2.6% of total ASEAN trade, as compared to China (15.2%), Japan (10.5%) and South Korea (5.4%) accounting for almost a third of ASEAN’s external trade. This also comes at a time when intra-RCEP bilateral trade accounts for almost a third of their total exports, with China already taking up an increasing chunk of this share (as of 2018). A simple look at India’s bilateral trade deficits with the ASEAN, Japan and Korea gives us a picture of where things stand for India vis-a-vis the ASEAN.

The Chinese Element…

China’s relative strength as a trading partner in the region is only set to grow further with the signing of the RCEP which would allow for much greater trade and supply chain harmonization among all these countries, preserving the centrality of China in these global and regional supply chain considerations. This is perfectly in sync with China’s grand strategy of gaining much greater economic foothold amongst a collective of very large emerging markets in the region, fending off India’s renewed urge in forging major partnerships with many of these economies as a feasible counterweight to China in Asia in economic terms.

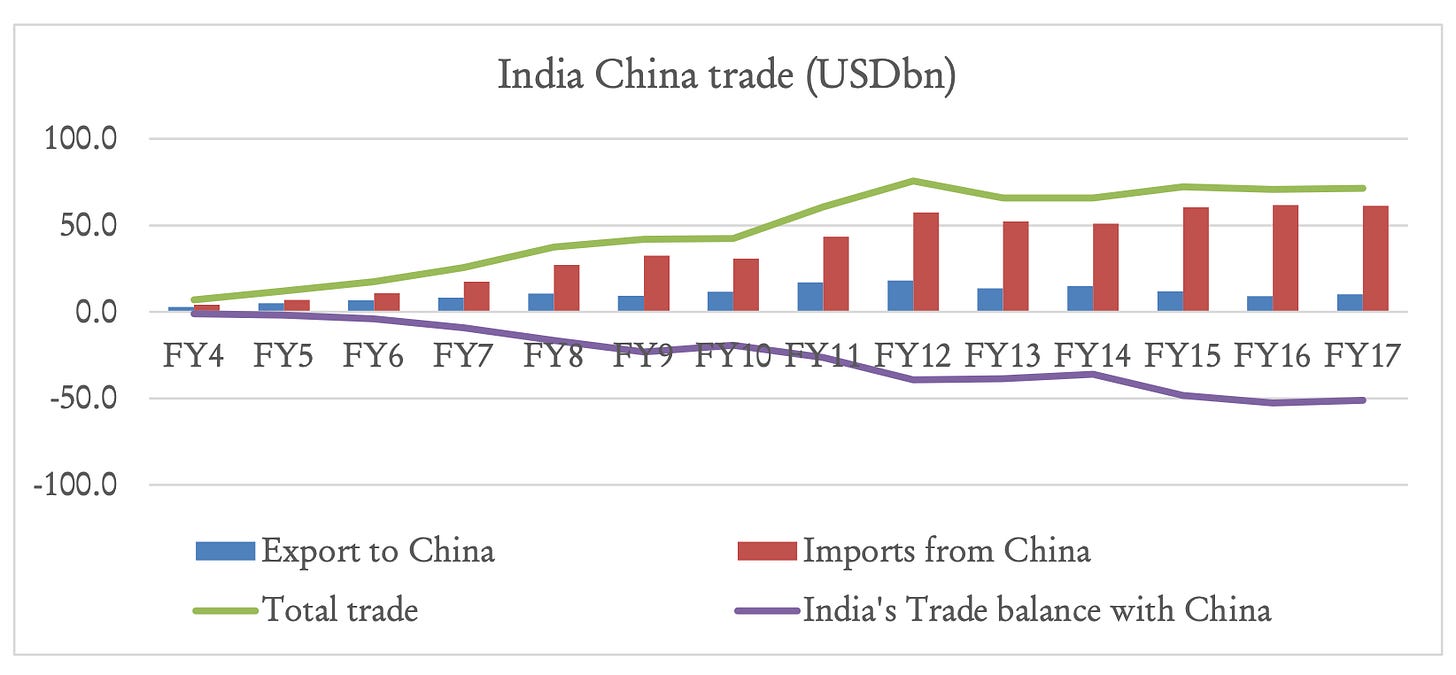

One of India’s principal concerns has been that any FTA of this nature would lead to a flooding of its domestic markets with imports from other trade partners (particularly China), thereby weeding out similar and competing domestic alternatives which might be relatively more inferior or uncompetitive in nature. India’s bilateral trade deficit with China has increased thirteen-fold and accounts for almost half of India’s overall trade deficit - something which would only be bound to increase with India’s entry into the RCEP where China is bound to play a more dominant role. Inclusion would naturally go against India’s domestic anti-China political rhetoric, building up since 2014, which the current government has been using against the backdrop of the pandemic to shore up political support.

The Competitiveness factor…

The fear of domestic markets being flooded with Chinese products is not just based on strategic anti-China dispositions but also on a much larger and fundamental fear of Indian products not being able to compete with their foreign counterparts. This has been an issue not just in terms of India’s flatlining exports but also in the calculus of India’s rising trade barriers.

India’s un-competitiveness in merchandise trade has been visible in terms of how India stands apart from many of its other emerging market peers in using exports as a vehicle of economic growth. Despite periods of very high growth, India’s share in global merchandise exports has stagnated to around 1.7% which partially alludes to a concern about the competitiveness of Indian exports in global markets. India’s structural impediments to enhancing exports include lack of adequate credit, prohibitive interest rates, labour productivity and lack of firm friendly legal and policy frameworks which prevent many of these firms engaged in global trade to increase their competitiveness in global markets.

India also faces a spectrum of structural issues around trade such as logistics and trade facilitation. India’s world ranking in the World Bank Logistics Preparedness Index has only declined through 2016 and 2018, indicating that either improvements in trade logistics are absent or not at par with many other competing economies in the global markets. In India, the cost of logistics as a percentage of GDP stands at 14% of GDP as compared to the US and Germany which stand at 8.5% and 9% respectively. Simply reducing the costs of these logistics would induce an increase in the quantity of India’s annual trade. This points to one of the main structural impediments to trade in the country, which is the lack of investment in infrastructure and logistics which could serve to reduce many of these significant costs associated with logistics.

Paranoia of Protectionism…

The current government is conspicuous also in its retreat from a regime of freer trade with the imposition of a regime of growing and renewed tariffs on merchandise trade, thereby signalling a growing inward turn and shrinking appetite to engage with global trade markets.

India has also been infamous for its extremely restrictive set of Non Tariff Barriers (NTBs) imposed on trading partners which further hamper the quantum of trade conducted. This is reflected in India’s recent spar with the USA on the latter withdrawing its GSP privileges from India due to the creation of trade barriers that hamper US commerce with India. With the current pandemic, the Modi Government’s “Atmanirbharta” push only implies a greater decoupling from global trade and supply chains in the aftermath of the pandemic.

While this sort of a protectionist policy approach might seem to be attractive to core nationalist voters, it makes little sense for an emerging market like India which has massive untapped potential in terms of taking up greater reigns in global trade for years to come. One of the massive detriments from these wholesale protectionist measures is the lack of any concerted effort in creating either a grand strategy going forward for global trade and bypassing the whole process of building consensus around issues which serve as structural impediments to trade in India. The latter allows politicians an escape hatch to deal with most of the structural impediments that I had mentioned a couple of paragraphs ago.

Uneasy political economy of consensus…

The political economy behind India’s already slow reform process presents major challenges to a structured and logical trade policy in the country. Successive governments over the years have adopted a hap-hazard approach in dealing with issues which are at the heart of India’s trade policy. Consensus building around different key stakeholders across a gamut of industries takes years and the compulsions of electoral politics often overpowers the need to follow economic rationale in sticking many such reform-oriented efforts. Such an approach can neither happen at the behest of the compulsions of electoral politics, nor can we expect it be fast-tracked at the time of trade deal negotiations. This is an architecture which successive governments needed to have invested in fostering over decades, while thinking about their vision for India going forward.

As the recent protests around the Agricultural Bills indicate, consensus over structural reform isn’t built overnight - however we assume otherwise. This slow arduous process inevitably takes its ugly head out in times when India has to be present at the signing table with other economies and give concessions to them on access to India’s relatively underdeveloped markets. Recently however this has taken a diametrically opposite turn where key stakeholders are not consulted enough in terms of major economic policies which are pushed through the parliament without much debate or discussion. India has often been unable to strike the right balance in balancing different groups and the political economy to any such lasting reforms to ease trade in India will have to follow an extremely tough road ahead.

India’s waning future in global trade…

While India has shown urgency off late in trying to renegotiate its FTA with ASEAN countries as a means of by-passing the RCEP, the member nations have put RCEP ratifications and final negotiations above India’s efforts, much to Indian chagrin. This exactly underscores the degree of salience India would expect to receive from many of these major economic blocs in the absence of a show of greater willingness to engage with these economies in terms of trade and investment relationships. India’s trade policy architecture (or whatever exists of it) needs to be much more pro-active in line with India’s foreign policy ambitions with regards to these regions. That also simultaneously requires a much greater debate around the structural impediments to free-er trade in India and the creation of a consensus around the issues that need to be solved on this front.

In the aftermath of the pandemic, we have seen a mad scramble among many emerging market economies in their efforts to attract businesses which have wanted to relocate their operations from China to other low cost Industries. This effort has seen India trying to compete with economies like Bangladesh and Vietnam which have for the time being emerged as relatively more attractive destinations for many of these businesses. This underscores the scale of competition that India currently finds itself it in the midst of, with the emerging market narrative leading the shift on the trade front to many of these economies now, away from India, which will eventually be followed by cogs of the supply chain gradually refocusing on these economies. India’s inward push and inability to integrate itself further into these multilateral trade blocs will only serve to push these supply chains away from India for a considerable period of time going forward.

De-coupling from trade and supply chains can’t remain a viable rhetoric for an emerging market with global ambitions. India needs to find itself inside these trading blocs and supply chain arrangements to make itself a part of a changing global economic order, and use these forays to fuel their own economic rise not just as an economy but also as viable counterweight to China in Asia.

India’s inability to get its membership in the RCEP over the line, along with inabilities to further trade deals with major economies such as the US and the EU, also suggest the presence of common roadblocks which we must take very seriously, going forward.

First, is the issue of access to domestic markets in India which has been a long-standing issue among many of India’s aspirational trading partners who would want commensurate access to Indian markets for their own firms in exchange for giving unrestricted access to their own markets.

Secondly, quality and standards that need to be complied by Indian counterparts in trade so that Indian goods can meet the advanced environmental and other product regulations in many of these export markets.

Third, there has to be a significant removal of numerous compliance costs and non-tariff barriers in order to make trade easier with India within and without an FTA.

Fourth, Export competitiveness of India’s trade products needs major institutional consideration. We cannot be in a position as a rising economic superpower where we are unable to sign trade deals with the fear of imports flooding domestic markets. Policies aimed at export promotion need to also significantly consider increase the competitiveness of India’s trade products, which has become a common overriding issue for almost every trade negotiation that India is currently part of.

India’s ambitions to play a greater role in the world order have been underscored by it’s position as one of the key contributors to global growth in the last decade and a half, but haven’t been accompanied by accompanying forays into global export markets off late. India’s ambitions to play a greater role in the world order have been underscored by it’s position as one of the key contributors to global growth in the last decade and a half, but haven’t been accompanied by accompanying forays into global export markets off late.

The RCEP would have been a great such opportunity to force an administration with significant political capital to finally take the harder way out and force a majority of the institutions in the country to adapt and evolve to compete with other emerging markets through modern supply chains and trade networks. Ceding much of the economic initiative to China in the region, yet again, India has once again lost a key chance to embed itself firmly in one of the fastest growing regions in the world today.

As an instrument of foreign economic policy, trade has virtually become a non-existent tool in India’s strategic approach over the past decade, underscored by flatlining exports for a majority of this phase. The inability to ink key trade deals and carry them over the finishing line would also be a source of concern for any onlooker interested in Indian trade policy.

After all, you will not find a single country in the history of the world which has embraced prosperity in the absence of thriving trade.

Really fun read, very well-researched. You presented such a well-balanced argument, but I'm a little confused: Does India WANT to be a part of the RCEP?

I understand that there's a free trade faction and a protectionist one, and I see your point that, long-term, we need to part of such FTAs if we want to progress. But overall, do the people in-charge genuinely WANT to be a part of this new bloc if there are so many short-term disadvantages?

If we do, why isn't the government making concessions in NTB if it's in our favor to do so in the long-run? Are they playing hardball because they think they can enter the bloc later under better terms?